Gary Robins, managing partner at Rockpool Investments, a specialist in Enterprise Investment Scheme opportunities, discusses their benefits for HNW clients, such as inheritance tax mitigation. The views of Robins and his company are not necessarily endorsed by this publication.

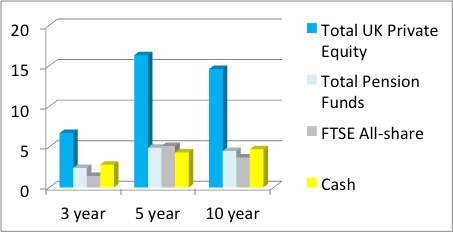

As we start to see the early signs of economic recovery, high net worth investors and family offices will be reviewing their investment strategies. As things get better, but while returns on cash remain so low, investors will be prepared to take more risk and increase allocations to alternative assets - particularly private equity. Over the short or long term, private equity has been shown to consistently outperform other asset classes, as shown in the figure below.

(Source: The BVCA 2010 Performance Report)

The experienced investor also knows that investing in growing private companies at this point of the cycle can deliver extremely attractive returns over the next three to five years.

Tightened lending

With the ready availability of bank lending to growth companies still highly questionable, the government is anxious to ensure that these companies have access to development capital from other sources. In particular, George Osborne, the UK finance minister, is seeking to persuade the HNW investor to fund growing small- and medium-sized enterprises, so-called SMEs, by introducing new rules for the Enterprise Investment Scheme (EIS).

From April, investors can invest £1 million ($1.58 million) per annum in EIS-qualifying companies and get 30 per cent income tax relief. Additionally, much larger companies will qualify under the EIS regime and they will be able to raise £10 million per annum under the new rules. These changes offer a real incentive for the high net worth community to build a portfolio of investments in more mature, lower-risk companies while entry valuations remain at post-recession levels. As the EIS also offers a loss relief cushion for an investment which results in a loss; it means that the 50 per cent higher rate taxpayer is really only risking 35p in the pound when making an EIS investment.

Consider the challenge a HNW investor faces when seeking to utilise their £1 million EIS allowance over the next year. Assuming they wants portfolio spread, they might be looking for four or five companies in which to invest £200,000 to £250,000 each. Finding the right opportunities is in itself difficult, but managing minority interests in several different companies is a more daunting prospect.

An easier route to investment

Rockpool is the brainchild of fund manager Nicola Horlick, and ex-3i executives Gary Robins and Matt Taylor, and we focus on a range of tax-efficient routes into private companies, including direct access into individual companies in units of £25,000 for the experienced investor and successful entrepreneur. Many investments are EIS-eligible, allowing investors to build their own bespoke portfolios and to utilise the full annual allowances. Rockpool encourages active involvement in the companies we back for those investors with appropriate experience, and these entrepreneurs invest alongside the completely passive HNW client.

Inheritance tax mitigation continues to occupy the thinking of HNW families. One way of achieving this is to invest in low-risk trading companies which are often in contractual partnerships with major blue-chip entities. The investor can benefit from business property relief, which places the investment outside of the investor's estate after just two years, thereby reducing the ultimate inheritance tax bill.

While Rockpool investments tends to focus on delivering either capital growth or on preserving capital, others are structured for the HNW investor more interested in high yields on redeemable loan notes and other instruments. Although these do not offer tax breaks, they are designed to produce annual returns ahead of the ultimate exit through a mixture of income and capital redemptions. These opportunities can appeal to offshore HNW clients or the UK taxpayer who has already used their full annual EIS allowance.

To conclude, as we start to move into more positive times, private equity could well play a bigger role in the portfolios of HNW individuals and family offices. As the asset class is not without risk, which is never the case, the ability to gain portfolio spread will be critical. With more generous annual limits on tax breaks such as the EIS, the challenge of finding sufficient investment-ready opportunities at the right time will be a tough one. This article has given some examples of how HNW investors can gain maximum benefit from the new rules on tax-efficient schemes and play a key role in funding SMEs in the upturn.